Account Debit Credit Utilities expense 000 Accounts payable 000 The company can make the utilities expense journal entry by debiting the utilities expense account and crediting the accounts payable at the period-end adjusting entry. Utilities expense journal entry without current period invoice This practice is common for the utilities expense as many companies usually only receive the current month invoice of the utility usage in a few days after the period end adjusting entry. If the company has not received the utility invoice from the supplier at the period end adjusting, it can use the previous period invoice to make the journal entry for utilities expense if the discrepancy from the current period is estimated to be immaterial, based on past experiences. Likewise, under the accrual basis of accounting, the company needs to make the utilities expense journal entry at the period end adjusting entry regardless it has received the invoice for the current period utility usage or not. You will see a record of the journal entries being reversed in the ‘Audit Trail’ report.In accounting, utilities expense is the cost for using the utilities during the period. For more information on reversing journal entries, please see this article.

Select ‘Create Journals’ at the bottom of the screen to complete the process. Choose the beginning of your new accounting year as the date of the reversal - this is ‘01 Apr 21’ for the electricity bill example - and enter a description in the field provided. This will create a reversed set of those journal entries. Select ‘Actions’ on the right-hand side of the relevant journal entries and select ‘Reverse in new journal entries’ from the drop-down menu. On the first day of the new accounting period, you need to reverse the accrual to remove the value allocated to the earlier period from your profit and loss account in the current year. In the example of an electricity bill, this is ‘250 Office Costs’.Ī record of the accrual being created will appear in the ‘ Audit Trail’ report.

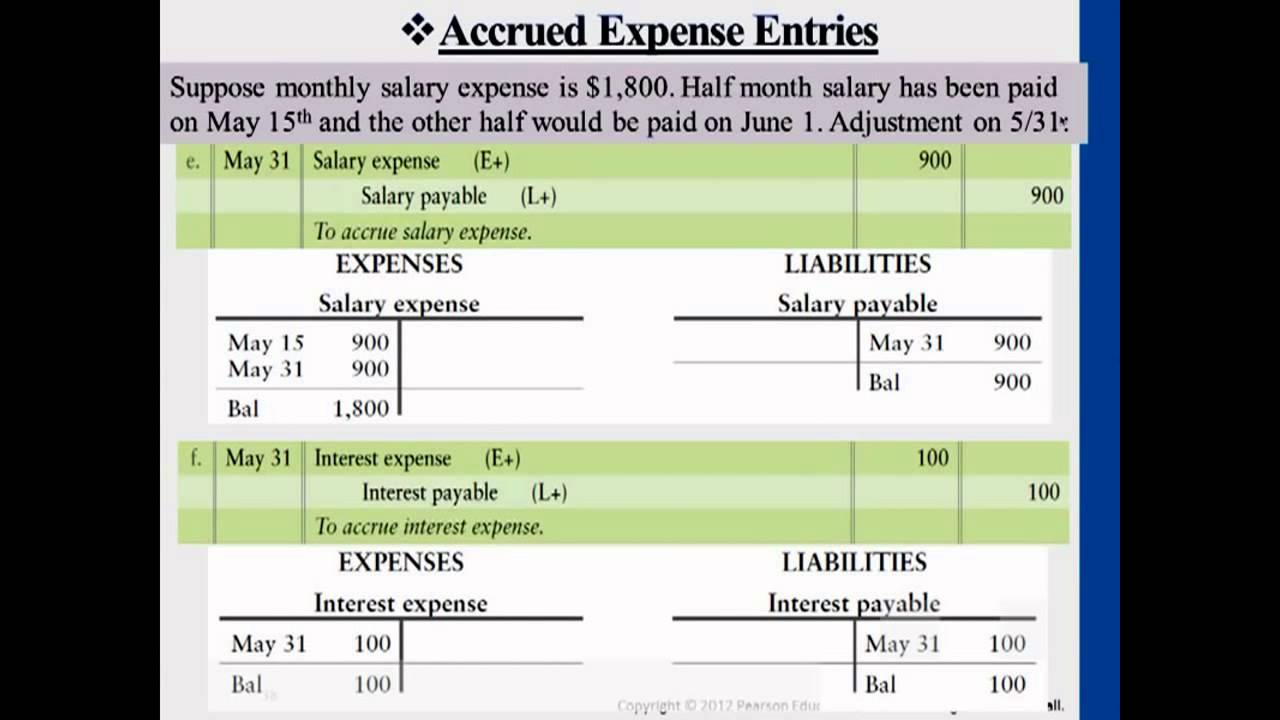

ACCRUED EXPENSES EXAMPLE JOURNAL ENTRIES CODE

You can record an accrual in FreeAgent by creating journal entries.

ACCRUED EXPENSES EXAMPLE JOURNAL ENTRIES HOW TO

If you’re unsure about how to record an accrual, please speak to your accountant. However, if you're on the VAT Flat Rate Scheme and the accrual isn't for a large asset, you should use the amount on the bill including VAT. Please note that when working out the value of the accrual, you should use the amount on the bill excluding VAT. Therefore, you need to record the £200 of electricity costs for February and March on your profit and loss account as at 31st March 2021 by recording those costs as an accrual.Īs the £200 will then be paid for in the accounting year to 31st March 2022, you'll need to remove it from your profit and loss account for that year by reversing the accrual. This would mean that your profit would be too high and you might pay too much tax, as part of your electricity payment relates to February and March 2021. So if your business prepares accounts to 31st March each year and you only include your electricity bill in your accounts when you pay it on 1st May, the £200 worth of monthly costs for February and March will be missing from your accounts to 31st March 2021. For example, you might pay a £300 electricity bill for your business's office on 1st May 2021, which covers electricity that the business used over a three-month period between 1st February and 30th April 2021. If you choose to prepare your accounts using the traditional accruals accounting basis, you need to record costs that your business incurs on your profit and loss account at the time when the business uses what it's paid for, which may not be when the cost was paid for. Please note that the steps below don't apply if you're preparing your accounts using the cash accounting basis. It also explains how to reverse an accrual.

This article explains what accruals are and how to record them in FreeAgent if you're preparing your accounts using the accrual accounting basis.

0 kommentar(er)

0 kommentar(er)